Due to mixed global cues, the Indian market ended the week on a slightly weaker note. Geopolitical uncertainties, as well as UK inflation reaching a 41-year high, weighed on investor confidence. DIIs became net buyers this week, domestic WPI inflation fell to a 19-month low in October, and CPI inflation was generally in line with expectations.

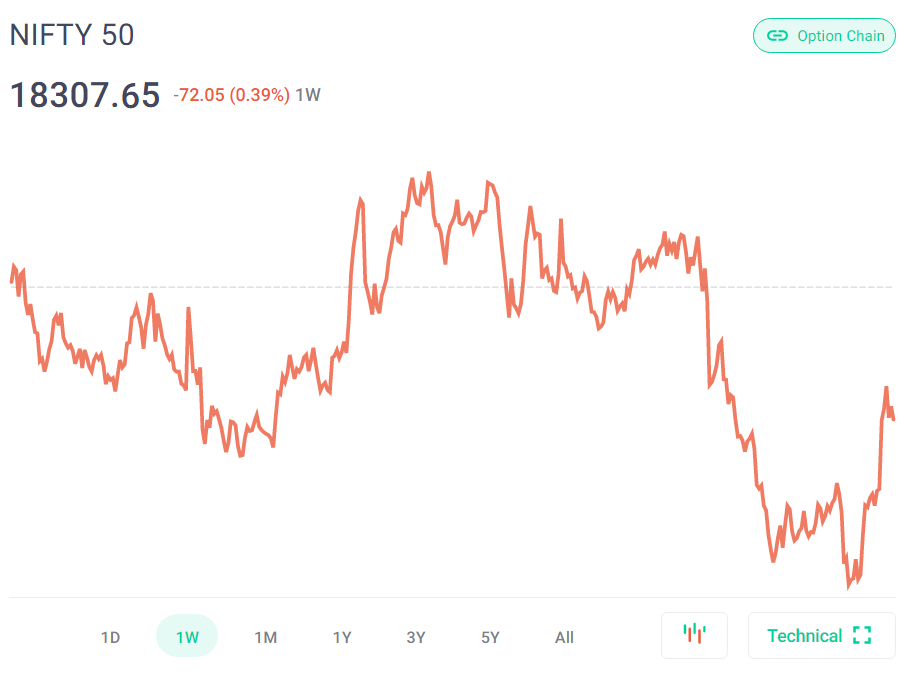

During the week, the BSE Sensex slid 124.66 points, or 0.20%, to close at 61,663.48, while the Nifty50 fell 72 points, or 0.39%, to 18,307.7.

Market Update

Nifty PSU Bank climbed 2.3%, while Nifty Bank gained 0.7% on the NSE. Nifty Media declined 5.3%, Nifty Auto lost 2%, while Nifty FMCG and Energy each sank 1.7%.

The BSE Mid-cap Index fell 1.3%, the BSE Small-cap Index down 0.8%, and the BSE Large-cap Index fell 0.5%.

The benchmark indices had erratic trading. Among sectors, the Media index lost the most, dropping more than 5%, while the PSU Bank index outperformed, rising more than 2%.

Foreign institutional investors (FIIs) purchased equities worth Rs 349.2 crore, while domestic institutional investors (DIIs) became net buyers this week, purchasing equities worth Rs 2,274.97 crore.

Due to lower food and commodity costs, domestic CPI inflation has slowed to 6.8%, but it remains above the RBI's tolerance range.

What Goes On?

According to Deloitte, India will grow by 6.5-7.1% in fiscal year 22-23.

In the face of rising inflation and an impending global slowdown, India is expected to grow by 6.5 to 7.1% in the fiscal year 2022-23, according to a report released on Thursday by Deloitte India.

According to the report, persistent inflation has been a challenge for policymakers over the last six months, not least because of the lengthy time lag between policy changes and results.

Despite the Reserve Bank of India (RBI) raising interest rates by 1.9 percentage points since April 2022, inflation has remained above the RBI's tolerance inflation range for more than 9 months. Furthermore, according to the report, the rogue dollar is driving up import bills and inflation.

According to the report, an impending global slowdown or even recession in a few advanced economies as early as the end of this year or early next year will exacerbate the situation.

The seemingly never-ending saga of global economic uncertainties has begun to hurt India's main growth drivers. Because the current economic environment is so volatile, it is unlikely that a consistent outlook will emerge from recent data releases, it added.

Amazon CEO says layoffs will continue into 2023.

Amazon CEO Andy Jassy indicated on Thursday that layoffs would continue long into 2023 as the business works on its annual planning.

Jassy stated in an internal message to employees that more job losses would be made as the company prepares its year and makes adjustments. "Decisions will be shared with impacted employees and organisations early in 2023," he added.

Amazon is presently undergoing an 'annual operations planning review,' which is assisting the corporation in determining what adjustments it should make in each of its businesses. The Amazon CEO also stated that the company will prioritise direct communication with layoff-ees before making broader public or internal statements.

According to media sources, the corporation is aiming to remove up to 10,000 positions, but this figure could change as the company evaluates its condition.

On Wednesday, the conglomerate laid off some employees from its gadgets department, kicking off its first wave of layoffs. Amazon's retail and human resources divisions are expected to be affected by the proposed job layoffs. Amazon anticipates the weakest revenue increase in its history for the holiday quarter. The corporation has already halted hiring for numerous corporate positions.

Cisco was the latest major corporation to disclose USD 600 million in severance pay on Wednesday, indicating that it was considering layoffs.

By FY23, the gaming industry will have created one million new jobs.

According to a survey by TeamLease Digital, the gaming industry is predicted to increase by 20 to 30% and create 1 lakh new direct and indirect jobs by fiscal year (FY) 2023.

According to the article "Gaming: Tomorrow's Blockbuster," the sector directly employs approximately 50,000 people, with programmers and developers accounting for 30% of the workforce.

The sector will add new jobs in areas such as programming (game developers, unity developers), testing (games test engineering, QA lead), animation (animators), design (motion graphic designers, virtual reality designers), artist (VFX and concept artists), and other miscellaneous roles (content writers, gaming journalists, web analyst) over the next year, according to the report.

Game producers (Rs 10 LPA), game designers (Rs 6.5 LPA), software engineers (Rs 5.5 LPA), game developers (Rs 5.25 LPA), and QA testers are the highest-paying profiles in the gaming industry (Rs 5.11 LPA).

In October, India's exports fell to $29.78 billion.

According to preliminary data issued by the commerce ministry on Tuesday, India's exports fell to USD 29.78 billion in October, compared to USD 35.73 billion in the same month of the previous year, while imports rose to USD 56.69 billion, up from USD 53.48 billion in October.

The report revealed a 33.12% increase in imports during the month to USD 436.81 billion. From April to October 2022, the export rate increased by 12.55% to 263.35 billion US dollars.

Compared to USD 32.88 billion in October 2021, non-petroleum, non-jewellery (gold, silver, and precious metals) imports were USD 34.40 billion in October 2022.

The predicted goods trade deficit for April to October 2022 is 173.46 billion dollars, compared to 94.16 billion dollars for April to October 2021.

The government stated that services exports were valued at USD 28.58 billion compared to USD 20.37 billion in October 2021. The expected value of imports of services in October 2022 was USD 16.30 billion, up from USD 11.64 billion in October 2021.

In October, India's WPI inflation fell to a 19-month low of 8.39%.

In October, India's wholesale inflation decreased to 8.39% from 10.70% in September, according to figures issued by the Ministry of Commerce & Industry on Monday.

In addition, this is the first time in 19 months that WPI inflation has decreased to single digits, after remaining above 10% for the previous 1.5 years.

The food inflation rate decreased from 8.08% in September to 6.48% in October. MoM, the index for manufactured goods declined 0.42%, and the inflation rate for fuel and electricity fell 1.65%.

IPO Watch

The Five-Star Business Finance IPO, subscribed 0.70 times and the Archean Chemical Industries IPO, subscribed 32.23 times, will list on the 21st of November.

Kaynes Technology, subscribed 34.16 times, will list on the 22nd of November

Inox Green Energy, subscribed 1.55 times, and the Keystone Realtors IPO, subscribed 2.01 times, will both list on the 24th of November

In listings, the Bikaji Foods IPO listed at Rs 323 at a premium of 7.67% above the issue price of 300. The Global Health IPO was listed at Rs 401 at a 19.35% premium over the issue price of Rs 336. Meanwhile, the Fusion Microfinance IPO listed at a loss of 2.17% at Rs 360 as compared to an issue price of Rs 368.

Motabhai ni Moti Vaato

Typically, the business cycle has a broad influence on commodity prices. Generally, they increase when the economy is booming and demand is relatively high, and they decrease when the economy is contracting and demand is relatively low. In contrast, these trends have been disturbed in recent years by global trade disputes, COVID, the Ukraine conflict, central bank rate hikes, and exchange rate swings.

In 2021, the global expansion rate was 6%. It is anticipated to reach 3.2% in 2022 and 2.7% in 2023. This is the lowest growth profile since 2001, excluding the global financial crisis and the severe phase of the Covivirus-19 epidemic.

Inflation was 4.7% worldwide in 2021. It is anticipated to increase to 8.8% in 2022, then will fall to 6.5% in 2023 and 4.1% in 2024.

To restore price stability in reaction to the rising inflationary tendency, the central banks of numerous nations tightened monetary policy. Actual interest rates have increased. Policymakers in all nations are simultaneously directing fiscal policy to reduce cost-of-living pressures while keeping a sufficiently restrictive stance consistent with monetary policy.

However, the monetary and fiscal policy stance adopted to curb price increases may have deflationary effects.

Before Russia invaded Ukraine, commodity prices were on the increase due to global supply disruptions and COVID's extensive market impact.

Further, when analysing the mood of the investor as a whole, I feel that a lot of investors have started realising that inflation is here and it is here (not) for good. You might seem to find your portfolio itself volatile and your investments not yielding. The bigger indices will show signs of a fall, and multiple startups and MNCs will lay off employees, the future is always uncertain but the current signs lead to a not-so-good volatile future. All in all, as always I will say one thing, there will come a time to invest, a time to buy because stocks will once again reach their lows. But, as the Big Bull once said, I still am bullish on India, India has the potential, the opportunity and the workforce to rebuild itself at a faster rate than most countries.

Glossary

QA Tester: A QA Tester is a professional who verifies the bug-free functionality and usability of new or existing software before it is released to the public.

WPI: Wholesale Price Index (WPI) indicates the price of items at the wholesale level, i.e., goods supplied in bulk and transacted between organisations as opposed to consumers. In some economies, the WPI serves as a proxy for inflation.

Important Links

I hope you enjoyed reading this edition of Motabhai ane Market!

Please like, comment and share!

Aavta Rehjo!

Motabhai.