Squiggly

In this edition: Snails pace, Is the market Plateauing?, a few earnings and Moti Vaato to end it

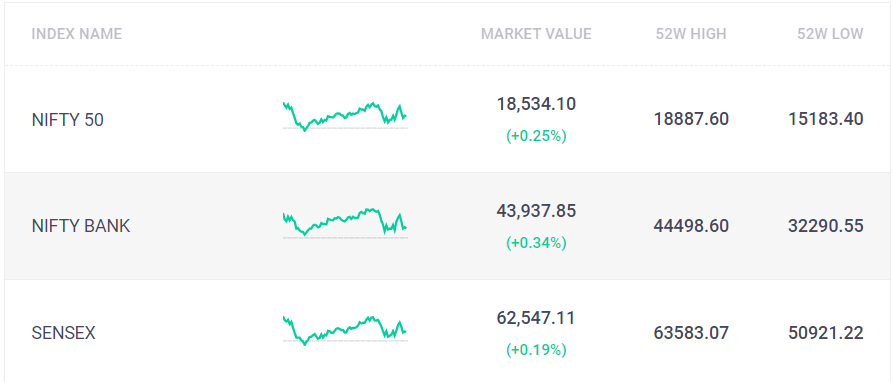

The Indian stock market saw little movement in the week ending June 2, despite reaching a five-month high earlier in the week. The overall indices, boosted by increased buying in broader markets, a strong performance of real estate stocks, and positive macroeconomic and automobile sales data, remained largely unchanged. The Sensex, consisting of 30 major stocks, gained 45.42 points to close at 62,547.11, while the Nifty, a broader index, rose 34.75 points to finish at 18,534.1.

The broader market performed well, with the BSE midcap index rising by almost 2% and the small-cap index increasing by 2.4% during the week. However, the large-cap index remained unchanged.

Global markets had a mixed performance due to concerns about a weak global growth outlook. India's GDP growth in the fourth quarter of FY23 exceeded expectations, reaching 6.1%.

Various sector indices on the BSE showed different trends. The real estate, healthcare, and auto indices gained around 1.5–3%. On the other hand, the oil and gas and energy indices experienced a decline of approximately 3%. The Nifty real estate index saw growth of nearly 4%, media rose by 3%, and healthcare added 2.5%. The oil and gas index decreased by 0.7%, while the energy index dropped by nearly 2%. The BSE smallcap index witnessed a significant surge of 2.4%.

International Market

On Friday, US stocks ended the day with gains as investors reacted positively to a labor market report that showed slower wage growth in May. This news suggested that the Federal Reserve might not raise interest rates in the upcoming weeks. Additionally, investors welcomed a deal in Washington that averted a potentially disastrous debt default.

The Nasdaq index, which is heavily focused on technology stocks, reached its highest level in 13 months and recorded its sixth consecutive week of gains, marking its strongest winning streak since January 2020.

While job growth in the US accelerated in May, the unemployment rate also rose to a seven-month high of 3.7%. This increase was due to more people actively seeking employment, indicating a slight easing of labor market conditions, according to the Labor Department. The higher unemployment rate was attributed to a decrease in household employment and an overall expansion of the workforce. The larger labor pool has reduced pressure on businesses to increase wages and has contributed to a deceleration in inflation.

The released data brought relief to investors, who widely anticipated that the Federal Reserve would pause its interest rate hikes at the upcoming policy meeting on June 13–14. This pause would mark the first halt since the Fed began its aggressive tightening of anti-inflation policies over a year ago.

However, some observers noted that the jobs data, which showed higher-than-expected numbers, indicates that the Fed has yet to fully control inflation.

The Dow Jones Industrial Average increased by 701.19 points, or 2.12%, closing at 33,762.76. The S&P 500 rose by 61.35 points, or 1.45%, reaching 4,282.37. The Nasdaq Composite added 139.78 points, or 1.07%, finishing at 13,240.77. Over the week, the S&P 500 grew by 1.82%, the Dow saw a 2.02% increase, and the Nasdaq gained 2.04%.

All 11 sectors of the S&P 500 experienced advances, with the materials index leading the way with a 3.4% rise. The consumer discretionary sector, housing Amazon, closely followed with a 2.2% increase.

Advancing issues outnumbered declining ones significantly on the NYSE, with a ratio of 4.75-to-1, while on Nasdaq, the ratio favored advancers with a 2.73-to-1 ratio. The S&P 500 recorded 15 new 52-week highs and two new lows, while the Nasdaq Composite saw 74 new highs and 40 new lows.

Market Movers

1. India’s Finished Steel Imports From China In April Reached Five-Year High

Based on preliminary government data examined by Reuters, India's imports of finished steel from China reached a five-year high in April, while the country's overall imports of steel hit a four-year high. China became the second-largest exporter of steel to India during that month, shipping 0.1 million metric tons, marking a 79% YoY increase. Imports from China accounted for nearly 25% of India's total finished steel imports in April. India imported 0.5 million metric tons of finished steel in April, the highest since 2019, representing a 38.2% YoY rise. The majority of China's steel exports to India consisted of cold-rolled sheets, used in various sectors such as automobiles and consumer durables. South Korea was the top exporter of finished steel to India in April, accounting for 32% of India's total imports. Despite the increase in imports, India remained a net exporter of finished steel in April, with 0.9 million metric tons being sold to countries such as Italy, Spain, Vietnam, Nepal, and the United Arab Emirates. Indian steel exports to Italy reached their highest level in six years. The European Union's plan to impose a levy on high-carbon goods imports, including steel, has raised concerns among Indian steelmakers. Domestically, India's crude steel production in April stood at 10.7 million metric tons, a 3.2% YoY increase. India's steel consumption is expected to grow by 7.5% during the current fiscal year, driven by demand from the construction, railway, and capital goods sectors.

2. India’s Foreign Exchange Reserve Falls For Second Week In A Row

India's foreign exchange reserves, as reported by the Reserve Bank of India (RBI), declined for the second consecutive week, reaching a one-month low of USD 589.14 billion as of May 26. This marks a decrease of USD 4.34 billion compared to the previous week. In the week ending May 19, reserves experienced the largest drop in over three months, falling by USD 6.05 billion. The RBI intervenes in the spot and forwards markets to prevent excessive volatility in the rupee. The changes in foreign currency assets, denominated in dollars, include the impact of currency fluctuations in other reserves held by the RBI. India's foreign exchange reserves also encompass its Reserve Tranche position in the International Monetary Fund.

3. GST Revenue Records 12% YoY Growth At 1.57 Lakh Cr In May

According to the Ministry of Finance's released data on Thursday, the gross Goods and Services Tax (GST) revenue for May 2023 amounted to 1,57,090 crore. The breakdown of the revenue includes CGST at Rs 28,411 crore, SGST at Rs 35,828 crore, IGST at Rs 81,363 crore (including Rs 41,772 crore collected on imported goods), and cess at Rs 11,489 crore (including Rs 1,057 crore collected on imported goods).

The government has settled Rs 35,369 crore to CGST and Rs 29,769 crore to SGST from IGST, resulting in a total revenue of Rs 63,780 crore for CGST and Rs 65,597 crore for SGST after the regular settlement in May 2023.

Compared to the same month last year, the GST revenues for May 2023 have increased by 12%. The income from the import of goods saw a 12% increase, and the revenues from domestic transactions (including the import of services) were 11% higher than the revenues from these sources in the same month last year.

4. Startup Funding Declines By 79% In Last Five Months

The funding landscape for Indian startups has experienced a substantial decline in the first five months of 2023 compared to the same period last year, indicating an extended period of reduced funding opportunities.

Data reveals that private equity and venture capital (PE/VC) funding for Indian startups dropped by 79% to USD 3.3 billion between January and May, in contrast to the USD 15.7 billion invested during the same period in the previous year. Furthermore, startups secured 247 funding rounds during this period, marking a significant decrease from the 613 funding rounds secured in the first five months of 2022.

In May, investors participated in around 53 funding rounds, investing approximately USD 948 million. This represents a decline compared to the USD 1.68 billion invested across 108 funding rounds in May of the previous year. The funding amount experienced a year-on-year decrease of roughly 44%, while the number of deals saw an even more substantial decline, more than halving in May 2023 compared to the same month in the previous year.

Although there was a slight increase in the funding amount from April, when approximately USD 342 million was invested in about 46 deals, the current levels still fall below those of 2022.

Investments in growth and late-stage startups have also faced significant pressure. Between January and May 2023, startups in this stage managed to secure USD 2.75 billion in funding across 105 deals. This is considerably lower than the five-month average of USD 8.9 billion across 189 late- and growth-stage deals in 2022.

Research?

Candlesticks

In stock market terms, candlesticks refer to a popular method of visually representing the price movements of a financial instrument, such as a stock, over a specific period of time. Candlestick charts are widely used by traders and analysts to analyze and predict market trends.

Each candlestick on a chart represents a particular time period, which can range from minutes to months, depending on the desired level of detail. The main components of a candlestick are the body and the wicks (also known as shadows or tails). The body represents the price range between the opening and closing prices during the given time period, while the wicks represent the highest and lowest prices reached within that same period.

The body of a candlestick is typically filled or colored to provide visual cues. In a "bullish" or positive candlestick, the body is usually filled or colored green, indicating that the closing price was higher than the opening price. Conversely, in a "bearish" or negative candlestick, the body is usually filled or colored red, indicating that the closing price was lower than the opening price.

Candlestick patterns and formations can provide insights into market sentiment and potential trend reversals. Traders often use these patterns in conjunction with other technical indicators to make informed decisions regarding buying, selling, or holding financial instruments.

How do I read candlestick data?

Reading candlestick data involves understanding the information conveyed by the various components of a candlestick. Here's a step-by-step guide on how to read candlestick data:

Identify the time period. Determine the time frame represented by each candlestick. It could be a minute, an hour, a day, a week, or any other specified period.

Recognize the components: Each candlestick has a body and wicks. The body represents the price range between the opening and closing prices, while the wicks represent the highest and lowest prices reached during the time period.

Interpret the body color: The body of the candlestick is typically filled or colored. A green or filled body indicates a bullish or positive candlestick, suggesting that the closing price was higher than the opening price. Conversely, a red or filled body represents a bearish or negative candlestick, indicating that the closing price was lower than the opening price.

Assess the length of the body: The length of the body can provide further insights. A long body indicates a significant price movement during the time period, while a short body suggests a relatively small price range.

Analyze the wicks: The length and position of the wicks relative to the body are crucial. The upper wick represents the highest price reached, and the lower wick represents the lowest price. Longer wicks suggest greater price volatility, while shorter wicks indicate less volatility.

Look for patterns and formations: Multiple candlesticks can form patterns that indicate potential trend reversals or continuations. Some common patterns include doji, hammer, engulfing, and spinning top. Understanding these patterns and their implications can help in making trading decisions.

Consider the context: It's important to analyze candlestick data in the broader context of market conditions, trendlines, support and resistance levels, and other technical indicators. Candlestick patterns are most useful when combined with other forms of analysis.

Remember that reading candlestick data is a skill that improves with experience and practice. It's essential to continue learning and refining your understanding of candlestick patterns and their interpretation. Additionally, consider utilizing resources such as books, courses, and online tutorials to deepen your knowledge.

Motabhai ni Moti Vaato

On Friday, India's major stock indices managed to make slight gains after two consecutive days of losses. However, the market struggled to sustain its recent upward momentum due to concerns that it may have risen too quickly. The passage of a bill in the US to raise the national debt limit brought some relief to investors, but attention will now turn to the Federal Reserve's upcoming interest rate decision in mid-June. The Sensex closed at 62,547.11, up 0.19%, while the Nifty settled at 18,534.10, up 0.25%. Although both indices reached their highest levels in six months during the week and recorded a 0.2% increase, traders were cautious ahead of the release of US jobs data, which could impact the Federal Reserve's decision. The report showed that job growth in May accelerated, but the unemployment rate also rose, indicating a potential easing of labor market conditions and potentially influencing the Federal Reserve to hold off on an interest rate hike this month.

In the domestic market, foreign portfolio investors (FPIs) were net sellers for the second consecutive session, while domestic institutions purchased shares. FPIs sold shares worth a net amount of Rs 658.88 crore in the cash segment, while domestic institutions bought shares worth Rs 581.85 crore, as per provisional stock exchange data.

The Nifty index is expected to face significant resistance around the 18,700 level. In terms of large-cap sectors, automobiles and pharmaceuticals are anticipated to perform well, although the market is likely to witness stock-specific movements due to factors such as MSCI rebalancing, positive economic data, and the upcoming Reserve Bank of India (RBI) policy meeting, according to Pagaria.

In Asia, Hong Kong experienced a notable rebound after entering oversold territory, while Japanese markets continued their upward trend, reaching new 32-year highs.

European markets made gains of more than 1%. On Wall Street, the three main indices were trading higher, driven by increases in financials, industrials, consumer discretionary, technology, and healthcare stocks. This was fueled by better-than-expected job data. At the time of reporting, the Dow Jones Industrial Average was up 1.74%, the S&P 500 was up 1.25%, and the Nasdaq Composite was up 0.84%.

All in all world market went up by such a teeny bit that it is barely noticeable, it shows that either the markets were tame this week, or the market will be taming further in coming weeks.

Word Wise

PE/VC

Private equity and venture capital are two types of investment strategies that involve investing in companies in exchange for partial ownership or equity stakes. While both private equity and venture capital involve investing in non-publicly traded companies, there are some key differences between the two.

Private Equity: Private equity (PE) refers to investments made in established companies that are not publicly traded on stock exchanges. Private equity firms typically raise capital from institutional investors such as pension funds, endowments, and wealthy individuals. This capital is then used to acquire controlling or significant ownership stakes in existing companies.

Private equity investments are usually made in mature businesses with stable cash flows and a proven track record. Private equity firms aim to improve the financial performance of the acquired companies by implementing various strategies, such as operational improvements, cost-cutting measures, and strategic restructurings. The goal is to enhance the value of the company over time and eventually exit the investment, typically through a sale or an initial public offering (IPO).

Venture Capital: Venture capital (VC), on the other hand, focuses on early-stage or high-growth companies that have a higher risk-reward profile. Venture capital firms invest in startups and emerging companies that are in their early stages of development and have the potential for significant growth. These companies often operate in technology, biotechnology, or other innovative sectors.

Venture capital funding is typically provided to help these companies scale their operations, develop new products or technologies, and expand their market reach. Venture capitalists take an equity stake in the company and provide not only financial support but also strategic guidance and industry expertise. They play an active role in the company's growth and often sit on the board of directors.

Venture capital investments are considered riskier due to the higher failure rates of startups, but they also have the potential for substantial returns if the invested companies are successful. The exit strategies for venture capital investments include acquisitions by larger companies or initial public offerings (IPOs).

In summary, private equity focuses on investing in established companies with stable cash flows, aiming to improve their performance and eventually exit the investment. Venture capital, on the other hand, invests in early-stage companies with high growth potential, providing both capital and expertise to help them grow and succeed.

I hope you enjoyed this week’s edition!

Lots of love!

Please don’t forget to like and share!

Motabhai.