Red Alert?

Ye dukh kahe khatam nahi hota be?

Well, Friday indices just made me shed a tear or two, I’m not going to lie. A fall of this magnitude had people asking me if selling was a good option or was it even safe to hold on. The ever optimistic Motabhai too for a moment had to look at the numbers and go:

The Market was in the mood for bloodshed this week, scaring investors and traders alike. Now why did the market decide to emulate Genghis Khan this week is something we’ll look at in this edition. Multiple reasons, multiple theories and most importantly, fear psychosis…

Inflation in USA not taking a break

As I said in an earlier edition, the stock markets do not operate in a buble and even the slightest of nudges to worldwide markets will affect other markets across the world.

The numbers for inflation in the largest economy in the world are estimated to remain high, at around a four-decade high. This will cause the Federal Reserve to tighten its monetary policy and hurt the stock market.

Prices are going up at the fastest rate in about 40 years because of the pandemic and the war in Ukraine, which have cut off supplies and made people want services again instead of goods. Investors are worried that the economy's growth might slow down.

Rupiya Niche Jaa raha

On Friday, the rate of Rupee to the US dollar crashed to a new low at around Rs. 78 per Dollar. Due to the weakness of currencies in emerging markets, the U.S. dollar has been in the lead.

US government bond yields went up, which helped the dollar. Weak economic data kept sharp gains in check. The dollar index kept going up and went over 103 by the end of the week.

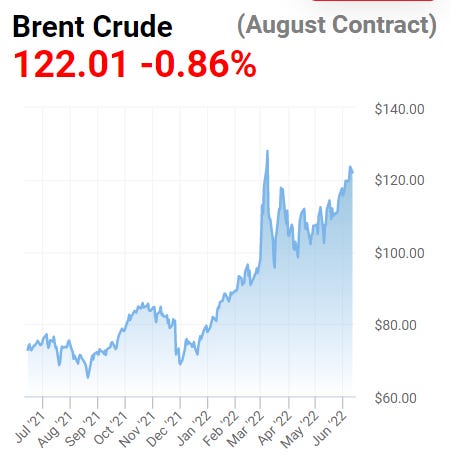

Tel sar ke upar Jaa raha hai

India's import bill, which is mostly made up of petroleum products, has gone up because crude oil prices have reached new highs. Even though crude prices went down on Friday, they were still close to a three-month high.

In the last two months, oil prices have been steadily going up. This is because the prices of refined products have gone up by a lot, which is a result of tight refining supplies and rising demand.

The FII Yard Sale continues

Investors from around the world have been pulling money out of Indian markets because the rupee is getting weaker and investors are afraid to take risks after the RBI raised interest rates.

Overseas investors have taken out Rs 1.62 lakh crore from the local stock markets in the first five months of the current year. Even in June, there has been a lot of pressure to sell, as FPIs have sold stocks in every session. There is only so much that the Domestic Retail and Institutional Investors can counter.

RBI’s Repo Rate Increase

The Reserve Bank of India increased the Repo Rate by 50 basis points this week, signalling more hikes in the future to reign in rising inflation. Rate snsitive stocks had a field day, but other stocks took a tumble. Banks increased loan interest rates, leading to consumer distress as well.

When the repo rate goes up, so does the cost for banks to borrow money, which they pass on to their customers by raising the interest rates on loans and deposits.

When the repo rate goes up, it costs more to borrow from commercial banks. The rate hike affects everything from home loans and car loans to education loans, personal loans, business loans, credit cards, and mortgages.

IPOs

No IPOs this week so, no analysis as well :(

Motabhai Ni Moti Vaato

As you can see from your portfolios, or the market as a whole, it’s all red isn’t it? I’m not here to say oh it’s going to be alright or what not, because guess what I too dont know at this juncture what is going to come next. But what i can tell you with confidence is that, I have faith in the stocks I have invested in, to give me returns in the long term.

I think someone said it very succintly, the crash on the early 1900s was so enormous, that people vowed never to own stocks. In 2022, with the advent and overuse of social media, the hysteria in even small speedbumps leads to mass exits, the urge for “multi-baggers” shoots up the prices of penny stocks. Imagining a crash in a such a scenario would be like looking at death in the eyes.

With Inflation across the world taking no steps backward, it is a precarious time, especially when your portfolio is growing downwards, more than upwards. Building your portfolio at such a time seems scary and buying stock only feels like dropping your money down a wormhole.

I too feel that the market in the current scenario isn’t a safe bet, and as long as the central banks and reserves do not know what to do, neither do we. They have the responsibility to reign in inflation or the value of the money we hold will soon be negligible. Tough times may just be ahead. But then again, No Promises!

If you have stocks right now, ones you trust, do not sell at a loss, there is no point in taking a loss when the market is heavily volatile, the liquidity you gain too won’t hold value in the long term.

No storytime today because midweek was a story and the upcoming one might be a story too!

Glossary

Dollar Index: The U.S. dollar index (USDX) shows how much the U.S. dollar is worth compared to a group of other currencies. After the Bretton Woods Agreement fell apart in 1973, the U.S. Federal Reserve created the USDX.

Repo Rate: Repo rate is short for "repurchase agreement or repurchase option." It is the rate at which banks and other organisations can borrow money from the central bank.

FII: A foreign institutional investor (FII) is an investor or investment fund that invests in a country other than the one where it is registered or has its main office. The phrase "foreign institutional investor" is probably used most often in India, where it refers to organisations from outside the country that invest in its financial markets.

Related Links

I hope you liked this week’s edition much more than you disliked the fall in the markets!

Aavta Rehjo!

Motabhai.

In depth study on volatile markets. Motabhai tussi great ho 😘