Hello!

After what would be an enforced sabbatical, Motabhai is back, since I’ve started working, I think I will be shifting to the longform, but on a monthly basis with what went by.

I understand there are certain aspects that are far beyond my realm of understanding to even teach you guys, but let’s learn together on the way.

Over the past year, the market has seen extreme highs and lows itself, but for one its grown exponentially to say the least, with detractors stating that this growth is untenable, but if it were for the layman to figure out how the market functions then I guess we’d all be Jhunjhunwalas.

Market Indices have grown from the mid-50k numbers in early 2023 to over 75k right now, propelled by growth in multiple market movers, elections (and exit polls :P) pushed this further.

Why has the market grown so much, the exit poll growth was already corrected by the election result fall right? Well to put it simply, the small cap market in India saw extreme growth over the past year, more than what certain bluechips have posted as well. With a growing international presence and a larger focus on the manufacturing AND service sectors, companies that have been able to augment themselves to this new boom have benefitted greatly from increased order books both international and domestic. Further, there is a large number of unlisted companies that have listed on the market, who have enjoyed great growth before they became public and that has further helped propel the market to newer highs. Technically speaking the belief of Institutional Investors, i.e., an investment body/company that invests in stocks, bonds, and other investment assets on behalf of its clients, customers, members, or shareholders, has also further emboldened the market and retail investors to have faith in the market.

As for what we foresee in the month to come and the month gone by, lets have a look…

To Bi(nny) or Not To Bi(nny)

“How far are you willing to go to gain control of your own fathers company?” some may ask. To the family of Binny Ltd, such limits supposedly do not exist.

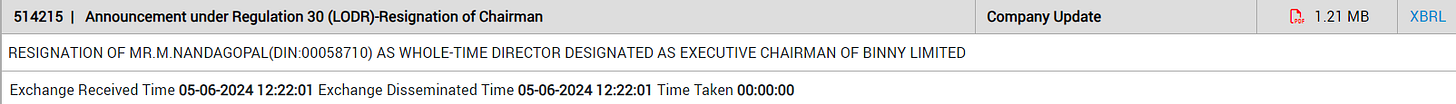

Let us look at the timeline with some screenshots (keep noting the exchange received time)

It is important to note that it is compulsory to attach the said resignation letter under the regulations, this filing, surprisingly, is void of any.

About 2 hours later, this is the next filing to the stock exchanges, for those interested to read the attached letter here it is...

MR M Nandagopal alleged that his son, Mr Arvind Nandagopal took his resignation when he was sedated, and that he doesn’t recollect resigning from the Company with his voluntary consent or free will.

WILD RIGHT? Well this isn’t even the beginning Theres enough twists and turns to this story to put Abbas-Mustan to shame.

3 hours later:

The resignation letter, that had apparently gone missing or the person uploading had “forgotten to attach” makes an appearance with a filing that states that the board had already approved his resignation by the board in its meeting dated June 3 , 2024 (note such a meeting doesn’t exist in their filings, and the regulations clearly state such a material event must be declared to the stock exchange (NOT 4 days later)).

Further Mr Arvind uploads a heartfelt letter to the filings alleging his father is being influenced (teary eyes much?) and how he had actually resigned and made Arvind his heir.

Suddenly its the RoC who comes into play, now what is the RoC, the Registrar of Companies is a body appointed by the Ministry of Corporate affairs to act as a registry of filings by the Companies and LLPs registered in their respective jurisdictions.

Aur ye dekho! in the span of less than a day, there have been two RoC filings, one with a dubious sign and one with no sign whatsoever being sent to the RoC to clarify if Mr M has resigned or not. AND WE STILL DONT KNOW!

Okay so now suddenly the Board has not approved of this resignation and a meeting has been called on the 10th of June to decide and deliberate on the same, oh wait it has been cancelled, oh wait it hasn’t! Nevermind they approved the resignation now. Someone take notes cause I sure have lost track of the times they’ve said something and done something else.

Meanwhile Mr M has taken this matter to the courts (something he should’ve done early on) and now we have an independent director swearing on affidavit that the CS and MR M’s daughter are forcing her to sign backdated documents. Meanwhile the CS makes a quick exit from the Company itself.

The last update to this matter is that the matter itself is now subjudice. Meanwhile Mr Arvind is busy calling for an Extra-ordinary General Meeting to approve his own father’s dubious resignation.

At this point even Michael Bay thinks this was far too much action in a span of 10 days. Company aise thodi hadapte hai bhai? thoda tehzeeb se hadap toh lo, jaise ki ek chote bhai ne kiya tha recent history mei (Khud samajh jao yaar, I can’t face the wrath of a touchy billionaire with temper tantrums)

No Hyundai(ya) for Indian Car Companies

With both Maruti and Tata Motor stocks high flying on the market, Hyundai said they want a piece of the pie and have filed their DRHP with the SEBI to list on Indian Stock exchanges. (Don’t quote me on this, of course this isn’t the actual reason, but rhetorics are fun)

First let’s look at the two competitors we mentioned, Maruti Suzuki India’s stock grew by around 33% over the past year, while the Tata Motors stock has grown around 74% over the past year. Meanwhile funds (Mutual, Index and ETFs) have grown at an annualized rate of around 75% on an average over the past year. So if i were Hyundai, just on the face value of it, this would seem like a good time for me to foray and offer further growth.

But lets dig deeper. The current “reported” size of the IPO as per the papers filed with the SEBI is Rs 25,000 crores, making it India’s largest IPO, even larger than the LIC IPO back in May 2022. Now the more surprising part is that all of it is an Offer for Sale (OFS), that means that the company is diluting no equity but rather parting with shares it already owns, and those amount to almost 142 million!

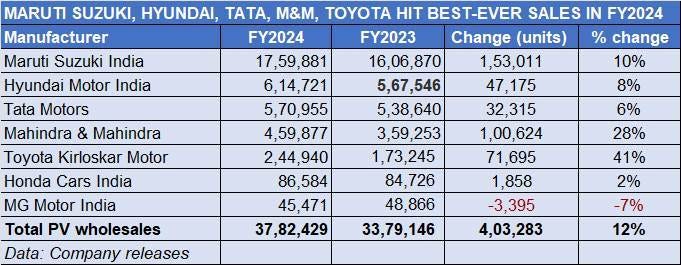

Looking at sales figures, Hyundai ranks second among sales for car makers in India

With that fantastic year-on-year growth, in just sales figures without the money metrics is a good indicator of their future.

But lets go even further (just because I’m boring), why does Hyundai want to list on the Indian market, what is so nice about the Indian market?

Well apart from us being the fastest growing stock market, Hyundai has seen a certain opportunity in the Indian Market, and no its not the Creta memes. First, EVs, no matter how much of the car guy in me hates them, I have to accept the fact that it is a growing market. In January 2024, CareEdge in it’s report on the automotive industry reported that EV sales grew by a good 50% YoY in 2023! Now we all know that this space in atleast passenger vehicles has largely been dominated by Tata Motors with its .ev range. Hyundai’s first foray with the Ioniq 5, although priced higher has been slightly successful, enough for them to also think that its worth trying to introduce EVs at other price points.

Further, the Luxury car market itself grew by 20% YoY in 2023, Hyundai senses an opportunity with its global Genesis brand. With luxury car sales in India skyrocketing, Hyundai could very well launch their homegrown luxury brand in India and price it far more competitively to other luxury brands to create a niche space for themself.

The Objects chapter givers nothing away, but one sure can ascertain a few things right? Further, just in case you got ready with your ASBA linked accounts, there’s time to the listing itself, the SEBI and stock exchanges will make observations, updates will come, there’s a long way to go. Thand rakh!

In case someone wants to read the DRHP : Here you go!

The Exit Poll Conundrum

Touchy topic right? Well where’s the fun if I don’t even address the elephant of elephants in the room, matlab Airavat hai ye toh.

So, lets have a short look at the timeline of events.

Before the exit polls and during their campaigns in multiple interviews, ministers of the government and spokespersons of the BJP egged people to buy stocks since their re-election on the 4th of June would propel stocks to new highs.

The Exit Polls on the 1st of June across news channels also claimed a record third landslide for the BJP led NDA in the Lok Sabha elections.

This led to the Stock marker reaching record breaking highs on the 3rd of June when the markets opened after 1st June.

But on the 4th of June, as we all know, there was no landslide. The BJP-led NDA did cross the required majority, but only just. The markets did not react well and investors lost a large amount of money in the fall that ensued.

In the forthcoming days, the Congress, led by Rahul Gandhi alleged that Narendra Modi and his ministers had indulged in illegal stock advice and called for a Joint Parliamentary Committee to investigate their role. Now why did he not approach the SEBI is beyond me but lets put that to the side.

Let’s look at the allegations levied on the PM and his ministers. Did they actually indulge in illegal investment advice? Well no not really.

Section 2(1)(l) of the SEBI (Investment Adviser) Regulations, 2013 state that "investment advice means advice relating to investing in, purchasing, selling or otherwise dealing in securities or investment products, and advice on investment portfolio containing securities or investment products, whether written, oral or through any other means of communication for the benefit of the client and shall include financial planning."

It also says that any such advice given through newspaper, magazines, any electronic or broadcasting or telecommunications medium, which is widely available to the public shall not be considered as investment advice for the purpose of these regulations.

Now what can be deemed from this definition only is that Mr Modi and his cabinet, optimistic of a win in the upcoming elections had spoken out of pure optimism without actually naming a stock, sector or theme to invest in. Optimism as such is not controlled by the regulations and rather what the Prime Minister and his cabinet spoke is covered under the good faith regulation 4(a) of the Investment Adviser Regulations that state that statements made in good faith with regards to the trends in financial markets or the economic situation where no particular security or investment product is named, do not require the person to be registered under the regulations.

So speaking on a purely law viewpoint, no this is in no way investment advice from the PM or his cabinet nor is it a violation of the Regulations. Now for the allegation that the cabinet did this to benefit their cronies, requires proof from the person levying the allegations themselves. More of a waiting game on that part.

Till then i leave the ball in your court to make informed decisions about how to approach and invest in the market, and believe in no ones advice but your own.

PayT(i)m(e) for Zomato?

News is ripe that Deepinder Goyal led Zomato is in to buy currently struggling Paytm’s movies and tickets business for a cool 1500 crore.

It is important to note both companies are listed on the stock market, Zomato under its own name and Paytm under the name of its parent One97 Communications.

News states that Paytm will first announce the merger of its Movies and Ticketing businesses, i.e., the Merger of Paytm Movies and Paytm Insider before announcing the sale.

What does this mean for Zomato and its shareholders?

Let’s first look at the speculated pysche behind the deal. Zomato technically has already forayed into the ticketing business one way or the other, be it their own Zomaland and then of course the very successful Post Malone concert (I wasn’t there to confirm if it was or not but everyone who went says it was) or for that matter event tickets for parties during major events like New Years’. So, it for one is not something new they are experimenting with.

This seems more like an expansion of an already running business arm. It might spawn a new app, or a new tab on your existing Zomato apps, God only knows.

But what I do know is that firstly this will serve as a much needed cash infusion for the embattled Paytm as its been in turmoil for a while now with first the issues with the RBI through its Payments Bank and then a slight loss of shareholder trust. Vijay Shekhar Sharma has held the ship well for quite a while, but a cash infusion of this stature and the letting go of an arm from the app would help them further in focusing their growth in a direction they would be more comfortable in.

Again at the current juncture, this is PURELY based out of reports in news media. It does seem likely to happen but let’s wait.

Not so Bright(com)

Brightcom group has recently been suspended from trading on both stock exchanges for failing to declare its data for two consecutive quarters (taking notes from BYJU’s it seems).

First NSE moved the stock to the Z category which basically stalls all intraday trades in the stock and only allows trades where the buying party has 100% of the funds required for the delivery of the stock.

Then the company announced its results for the first quarter of 2024 without announcing when the december results would be announced, leaving investors in the lurch.

But this just is the tip of the iceberg. Brightcom has a lot going on.

In February, its Promoter chairman was barred from holding directorships in any listed company by a confirmatory order of the SEBI which further also barred the company itself from trading on the securities markets.

In August 2023, 23 individuals in plum positions in the company were caught round tripping, ie, transferring the company’s funds via multiple accounts to falsely portray receipt of proceeds through preferential allotment of shares.

It is also alleged that he company also undertook a preferential issue of shares in FY 2021 via directly and indirectly connected companies to advance loans to its subsidiaries.

Daya ye daal mei kuch kala nahi, daal hi puri kaali hai!

George-ception

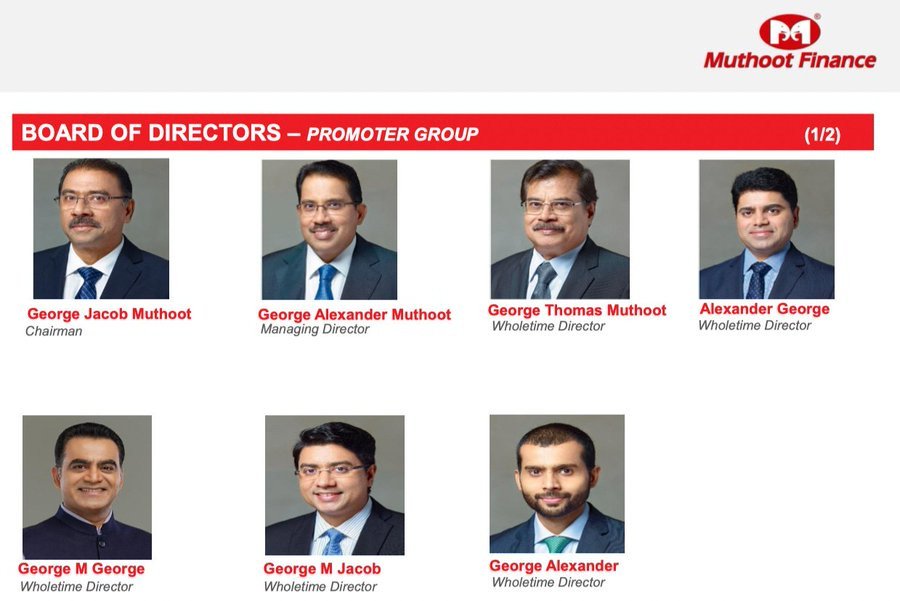

How to put this simply? George is all 7 directors of Muthoot Finance Co.

How is one man 7 people is the first question that came to your mind right? well to make it more confusing for you, George appears 8 times as 7 directors of Muthoot Finance. I’m pretty sure you think I’m off the rails. I promise I’m not.

Well, have a look yourself

Every. Single. Director. is named George, one of them is George George.

I don’t even want to imagine board meetings in such a scenario, but i sure can ascertain they must be fun to say the least.

“Aye George!” the table turns around “Which one?”

With that I bring this month’s edition to a close, as has been my promise I shall not provide any stock recommendations or advice, my job is to ensure you are briefed on the market and its happenings and I shall ensure you get access to the same.

Please note that nothing as say should be deemed as market or investment advice, with time I will teach you how to research but the results of that research will be your own.

Honestly speaking, I missed writing this newsletter, missed connecting with you people. I majorly missed the very thrill of discussing the market with so many like minded individuals.

I hope y’all welcome me back with the same love y’all have given this newsletter during its more consistent days.

As usual, please like, comment and share it with your friends if you do like it!

Love

Motabhai

Told a friend