An August Start?

Can the market Shakti-kant?

The market over the past week showed some stability as there were multiple market-moving announcements and news that could have gone the wrong way as well.

The BSE Sensex went up 817.68 points (1.42%) over the week, ending at 58,387.93, while the Nifty50 went up 239.25 points (1.39%) to 17,397.5 levels.

How has the market reacted to news around the world? What happened? and how?

Let’s have a look at this week’s edition

Market Highlights

After a long time, foreign institutional investors (FIIs) stayed net buyers for the whole week by buying Rs 6,991.54 crore worth of stocks, while domestic institutional investors (DIIs) became net sellers by selling Rs 1,765.59 crore worth of stocks.

The Indian rupee moved in a narrow range over the past week. On August 5, it was worth the same as it was on July 29: 79.24 per dollar.

Indices both sectoral and Capex divisions gained but also had multiple losers, therefore indicating choppy waters.

The six-member monetary policy committee (MPC), which is led by RBI Governor Shaktikanta Das, decided to raise the repo rate by 50 bps and keep its withdrawal of accommodative stance. This was mostly what was expected, so it wasn't a big deal.

Sabse Bada Rupaiya?

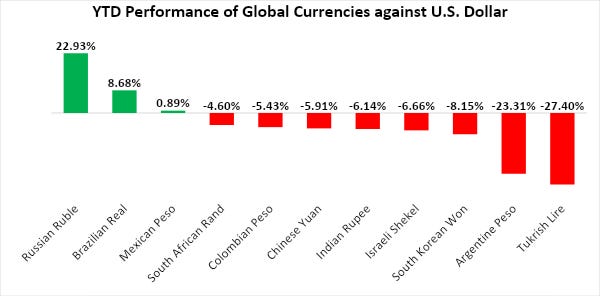

The risk on global markets has made it hard for the Indian rupee to stay strong against the US dollar. Last month, the Indian currency went over the 80-dollar mark. USDINR has dropped 6.14% so far this year. Most of its emerging market peers have fallen even more.

The bigger question that everyone is thinking about is whether the rupee will fall even more.

In 2018, the dollar had a similar rise. From a low of INR 64.84 in April 2018 to a high of INR 74.48 in October 2018, it went up. It went up for 7 months in a row. But in the eighth month, the USD fell back to the INR 69.70 level. This year, we're seeing the same thing happen. From a low of INR 73.76 in January '22 to a high of INR 80.21 in July '22, the USD kept going up.

The Relative Strength Index (RSI) of USDINR gives us another important piece of information. When the RSI is above 70, there is a good chance that dollar prices will change. In the last 10 years, we have seen this happen seven times. At the moment, the RSI of USDINR is above 70 and in the "overbought" zone. This means that the USD could lose value and the INR could gain value.

Motabhai ni Moti Vaato

The market, as I mentioned in my first ever newsletter, is no one’s friend, but it is no one’s enemy either, the market is an entity that charts its course, pushed around by multiple factors of course.

Looking at the week gone by the market held its own with multiple factors pushing it both upwards and downwards. First up, FIIs becoming net buyers for a whole dog-gone week is one of the best news you could receive as a market participant. This indicates that there is a rebound in the trust placed in Indian markets as Foreign investors return to the fold. What is concerning for retail investors is that a lot of the shares these FIIs have invested in are close to their 52-week lows, therefore indicating that the DII is taking a loss whilst the FII buys at a price closer to what they had bought earlier at.

The Monetary policy brought some respite as well, as the rate hike was something the market anticipated. Although the RBI not changing its outlook on inflation figures is a bit concerning as 6.7% as an estimate seems a bit low and it is important to look at Q3 and Q4 results for this year to gauge whether the governor and crew got it correct.

Coming to individuals and what to watch out for in the next week. Well most importantly, both the United States and China are releasing their inflation metrics for the past quarter alongside rate reviews. It will be important to see how these countries define a recession because the United States has decided that denial is the best course forward.

Another major event is Speaker Nancy Pelosi visiting Taiwan, leading to the Chinese pushing for an aggressive military exercise because of which a ballistic missile landed in the EEZ (Exclusive Economic Zone) of Japan. These events wouldn’t bode well for the world at large so it is important to monitor these as well

Overall, to make a prediction, I wouldn’t be too hopeful for the market next week as it is going to take more than a few hits from multiple areas as news and newsmakers decide on policy and people.

Glossary

Monetary Policy Committee: Monetary Policy Committee was made to set the benchmark policy interest rate (repo rate) to keep inflation within a certain target level. With the help and advice of the internal team and the technical advisory committee, the RBI governor is in charge of making decisions about monetary policy.

RSI: In technical analysis, the relative strength index (RSI) is used to show how fast something is moving. RSI looks at how fast and how much a security's price has changed recently to figure out if its price is overvalued or undervalued.

Related Links

I hope you enjoyed this week’s edition!

Aavta Rehjo!

Motabhai.

Very apt and correct analysis Motabhai keep up the good work. 1 request give synopsis sector & company wise analysis of past present and future. So we 2 Can rake in some moolah